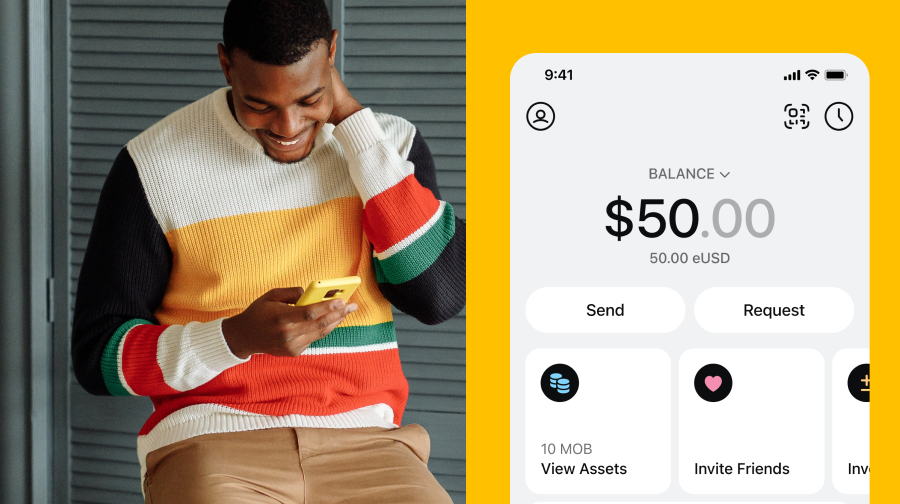

Send and receive payments globally from anyone you can text for (basically) free

Download NowDownload

Sentz

Join us in the future of

cross-border payments

Instant Money

Transfer

Receive your money in

five seconds (or less!)

Basically

Free

Payments cost a

fraction of a cent

Simple &

Easy

Get paid with a phone

number - it's that easy

Easy as

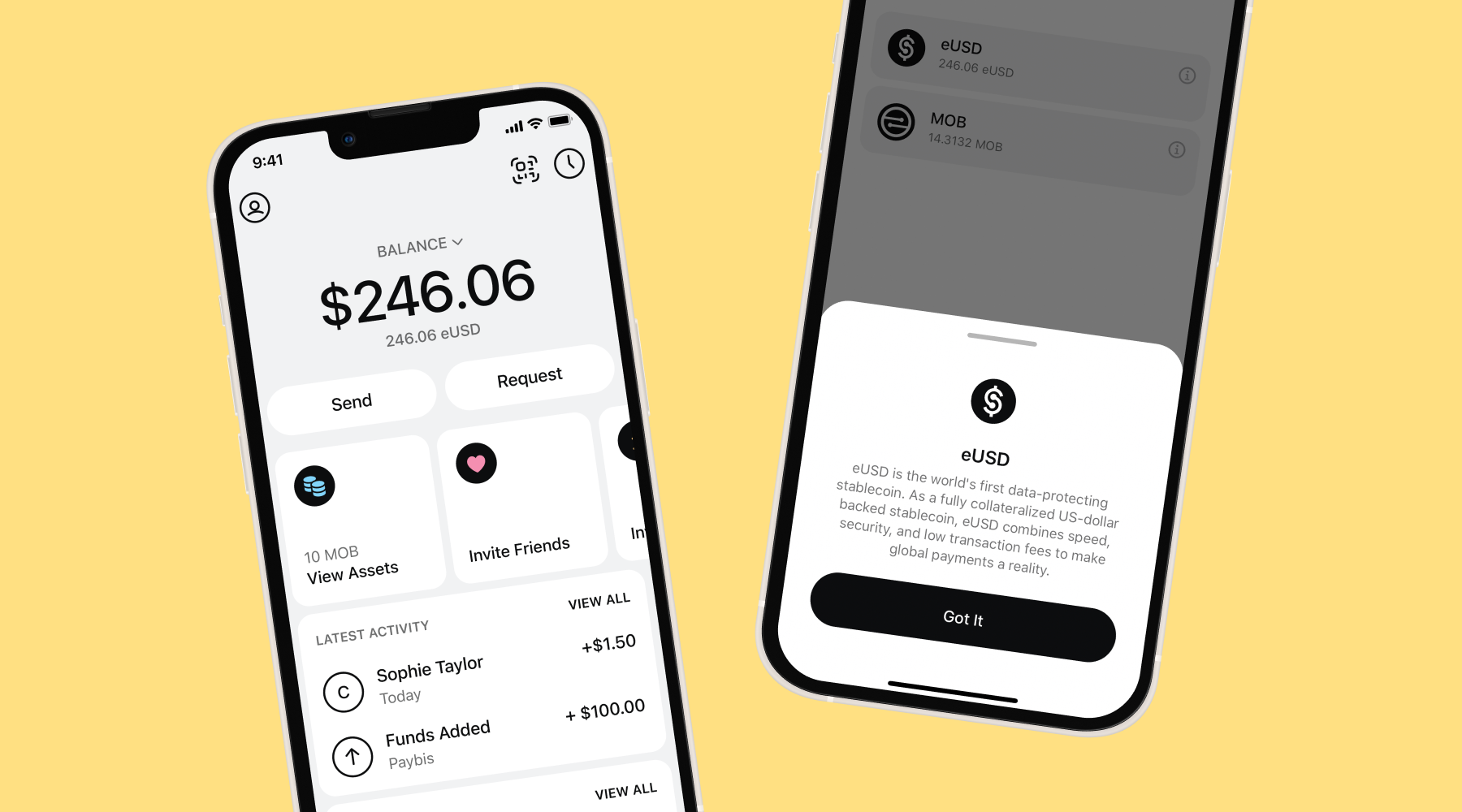

Holding USD*

Withdraw instantly into your

local currency as needed

Reliable &

Secure

Encrypted payments -- only

share with trusted parties

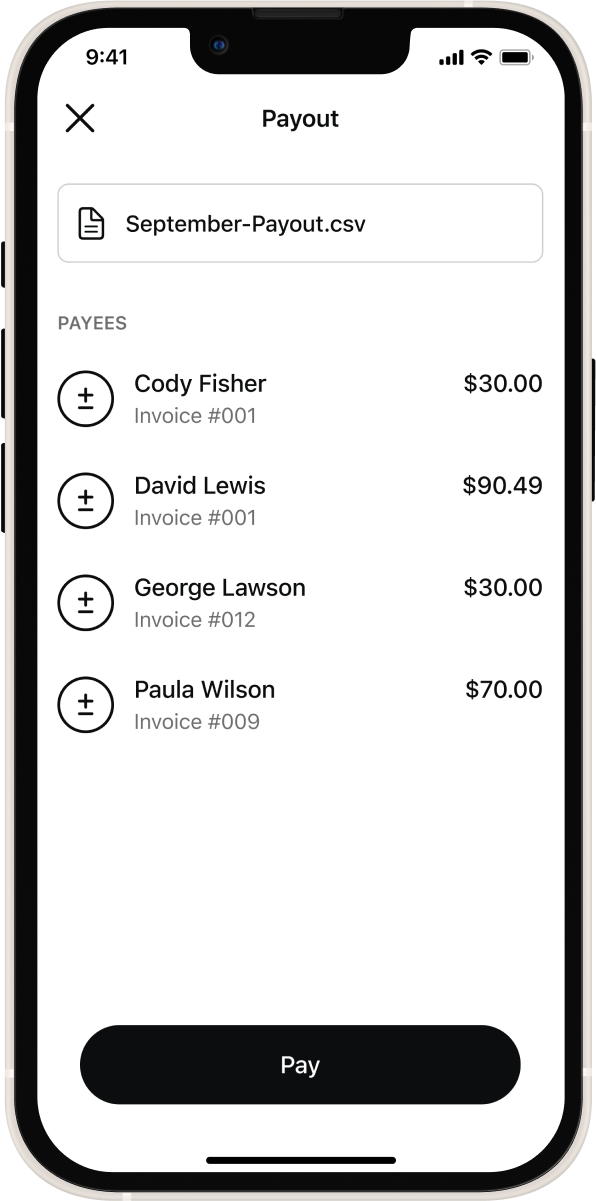

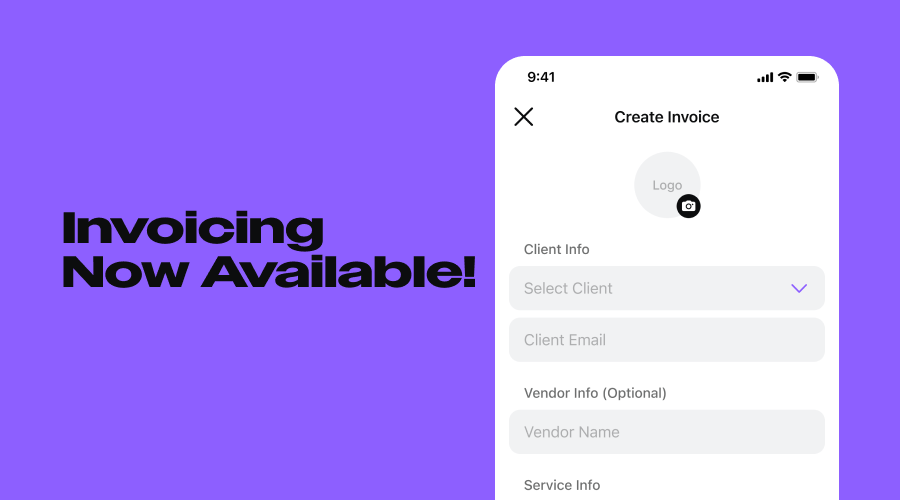

The easiest way to get paid as a freelancer

Why wait to get paid for your hard work? Sentz lets you get paid in seconds (versus days or weeks) from clients and businesses, no matter where they are in the world.

Freelancers Get Paid in Less Than 5 Seconds with Sentz

- Receive your payments in eUSD.

- Low transaction fees.

- Send invoices in seconds.

- Withdraw as USDT or USDC – bank withdrawals are coming soon to Nigeria!

The fastest and safest way to send payments

Sending payments to your friends and family globally shouldn't equal a headache.

Sentz is the fastest, easiest, most secure and inexpensive way to send money to friends and family in a different country.

International Payments for Businesses

Get in Touch